The UK government’s Office for Budget Responsibility (OBR) is preparing to write down the value of taxpayers’ stake in Royal Bank of Scotland for the second time in six months, according to a report in the Financial Times.

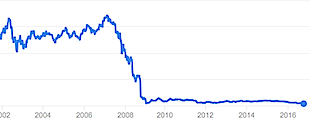

The OBR is preparing to recalculate the amount the government will be able to raise by selling its 73% stake in the bank, which it acquired at roughly 503p per share during a £45 billion state bail out in 2008, the report said.

On Monday, RBS shares closed around 171p — giving the government’s holding in RBS a current stock market value of only £15 billion.

The news came as RBS prepares to receive the Financial Conduct Authority’s report into allegations that its controversial corporate restructuring group deliberately caused thousands of small businesses to fail just after the 2008 financial crisis.

RBS chairman Howard Davies, a former chairman of the Financial Services Authority, said in an interview on CNBC that RBS is hoping the FCA will produce its report soon.

Davies said: “… we have looked in the past carefully at the way in which distressed businesses were handled in the aftermath of the recession …

“And we accept that in some cases that was not done as well as it should be — the people were not communicated to properly, they didn’t understand what was happening … so we accept all that.

“What we don’t accept is that there was any kind of systematic attempt to put people out of business for the benefit of the bank.

“But it’s for the FCA to judge all this and we hope they’ll do so fairly soon.”

Asked if he agreed that shareholders should pay for misdemeanors of the past or if the executives allegedly involved should be more accountable, Davies replied: “Well, unfortunately, the cases, the large volume cases, come against the institution and for the simple reason that the institution has deeper pockets than the individuals …

“I think it’s inevitable that these cases come against institutions …

“The criminal law is very difficult — and to prove that people have behaved criminally beyond reasonable doubt is a much higher hurdle than to prove a civil charge against an institution …

“I don’t think there is anybody else other than shareholders who can pay.”