Edinburgh-based accounting software firm FreeAgent has announced plans for a flotation on the Alternative Investment Market (AIM) of the London Stock Exchange in November.

FreeAgent said the initial public offering (IPO) will involve a placing of new ordinary shares with institutional investors.

The firm describes itself as a “provider of cloud-based Software-as-a-Service (SaaS) accounting software solutions and mobile applications designed specifically for UK micro-businesses — defined as sole traders and companies with fewer than 10 employees — and their accountants.”

The company said it is seeking admission to AIM “to raise funds to accelerate product development with a focus on the digital tax agenda, to scale-up customer acquisition with a particular emphasis on large accountancy practice customers and to repay existing debt.”

FreeAgent also announced it appointed Andy Roberts as non-executive chairman, saying Roberts “led The Innovation Group plc from 2009 until its sale to Carlyle Group in 2016 for £500 million.”

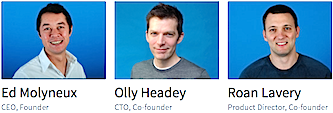

FreeAgent Holdings CEO Ed Molyneux said: “With five million micro-businesses in the UK, FreeAgent is well positioned to transition micro-businesses away from relying on spreadsheets to manage their finances to taking a more automated and digital approach to their accounting.

“Developed specifically for micro-business, FreeAgent provides these businesses with a dedicated SaaS solution that has the depth of functionality to cater for all of their business finance requirements, from time slips to tax returns and quality after-sales support.

“FreeAgent’s software already helps 52,000 business owners, providing the group with excellent revenue visibility.

“FreeAgent’s differientated product puts businesses in charge of their finances, allowing them to see the big picture and automatically generating their tax returns.

“We believe that the proposed placing and admission to AIM will provide the springboard necessary to help us accelerate our growth and to attract more customers through both our direct and accountancy practice channels, introducing the benefits of FreeAgent to thousands of other businesses.”

FreeAgent said it has a “proven track record of revenue growth” which grew at a compound annual rate of 34% in the two years from March 31, 2014 to March 31, 2016.

It said its ACMRR (annualised committed monthly recurring revenue) at the financial year end stood at £6.8 million (unaudited) and as at September 30, 2016, had further increased to £7.7 million (unaudited), with a gross profit margin of more than 80%.

Molyneux graduated in Engineering and Computer Science from The Queen’s College, Oxford in 1992 and spent 11 years in the Royal Air Force, including two tours of duty as a Harrier pilot, before six years as director of his own technical consultancy business.

Nplus1 Singer Advisory LLP is acting as nominated advisor and sole broker to FreeAgent.