Edinburgh-based accounting software firm FreeAgent said its shares floated on the Alternative Investment Market (AIM) of the London Stock Exchange on Wednesday.

FreeAgent said it raised £10.7 million from institutional investors via a placing of 9,523,810 new ordinary shares raising gross proceeds of £8 million for the company and 3,192,850 existing ordinary shares, raising gross proceeds of £2.7 million for selling shareholders — in each case at a price of 84p per share.

Upon admission to AIM, FreeAgent had a market capitalisation of £34.1 million.

The shares rose on their first day of trading to close at 87.5p.

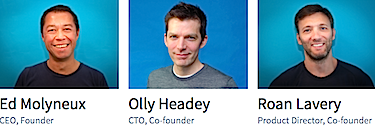

FreeAgent CEO Ed Molyneux said: “This is a transformational event for FreeAgent.

“I am delighted by the interest shown in FreeAgent by investors, resulting in our successful placing, and equally delighted to welcome on board our new shareholders.

“Our entry to the AIM market is a positive step that marks the next phase of FreeAgent’s development as we progress our growth strategy. We look forward to our future as a quoted company with confidence.”

FreeAgent describes itself as a “provider of cloud-based Software-as-a-Service (SaaS) accounting software solutions and mobile applications designed specifically for UK micro-businesses — defined as sole traders and companies with fewer than 10 employees — and their accountants.”