Edinburgh-based accounting software firm FreeAgent — which floated on the Alternative Investment Market (AIM) of the London Stock Exchange last month — said its revenue increased by 36% to £3.6 million in the six months to September 30, 2016.

FreeAgent said it made a net loss of £1.3 million reflecting investment in customer acquisition, a share options expense of £500,000 and unrealised losses on a loan facility of £200,000.

It said its “accounting practice clients” increased to 27,137 from 12,611 in the first half of 2015 and “direct clients” increased to 16,724 from 14,582.

FreeAgent describes itself as a “provider of cloud-based Software-as-a-Service (SaaS) accounting software solutions and mobile applications designed specifically for UK micro-businesses — defined as sole traders and companies with fewer than 10 employees — and their accountants.”

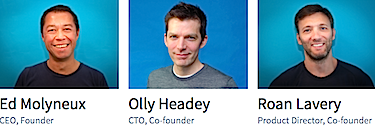

FreeAgent CEO Ed Molyneux said: “As a newly-listed public company, we are especially pleased to report strong performance in our first set of interim results.

“The 36% growth in revenue maintains our FY15 and FY16 growth rates, and at the same time we have also improved gross margins.

“The second half has started positively and we are confident we will report further significant progress within our full-year results, consistent with market expectations.”

In his outlook, Molyneux added: “Following the successful IPO post period end, the group has commenced recruitment to enlarge primarily its accountancy practice sales, and product and engineering teams.

“The Edinburgh market for software engineers remains competitive but the group is optimistic of being able to find the right people to fill roles in line with demand.

“October 2016 saw the soft launch of a new commercial collaboration with a major UK bank under which small business customers of that institution which meet FreeAgent’s core target market profile will be offered the branded FreeAgent SaaS solution as an additional part of their account on-boarding process.

“The group does not yet have meaningful visibility over the likely growth in this channel however we remain encouraged by this partnership with the full roll out to all New Business Call Centres expected in the New Year.”