Shares of Edinburgh-based FreeAgent Holdings, which provides accounting software for small businesses, rose for a second successive day following the announcement that it won a major contract with The Royal Bank of Scotland Plc.

FreeAgent shares were up almost 8% on Friday to around 117p, giving the firm a current stock market value of around £47 million.

FreeAgent — which floated on the Alternative Investment Market (AIM) of the London Stock Exchange in November — said recently that its revenue increased by 36% to £3.6 million in the six months to September 30, 2016.

In its IPO admission document, FreeAgent said that October 2016 had seen the soft launch of a new collaboration with a major UK bank under which small business customers of that institution would be offered the FreeAgent Software-as-a-Service (SaaS).

FreeAgent said the RBS contract “formalises and extends that collaboration.”

“Since 19 October 2016, RBS has piloted the use of FreeAgent’s SaaS Solution with its NatWest and Royal Bank of Scotland customers,” said FreeAgent.

“This offering will enable RBS’ business account customers to access FreeAgent’s software, catering for all of their business finance requirements from timeslips to tax returns and quality after sales support.”

Under the terms of the contract, the service is scheduled to be made available to RBS’ small business account customers through 2017.

The service will be offered free to RBS’ business bank account customers who agree to data sharing, with licences paid to FreeAgent directly by RBS.

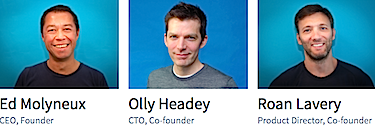

FreeAgent Holdings CEO Ed Molyneux said: “I am pleased to report that FreeAgent has formalised and extended its relationship with RBS to provide the benefits of FreeAgent to RBS’ business bank account customers.

“Given that our relationship with RBS only started in October 2016, we do not expect a material revenue contribution from licences sold under the agreement for the year ending 31 March 2017 and we expect an accurate picture of the level of take-up by RBS clients to emerge only once we have several months of operational data at our disposal.

“However, we are naturally excited about the potential for this new agreement, particularly once our services are made available to RBS’ back-book in H2 2017.”

Marcelino Castrillo, managing director of business and private banking at RBS, said: “The way customers want to bank with us is constantly changing, so it is important for us to innovate.

“From over 30 vendor proposals we chose FreeAgent because of their willingness to collaborate with us and shape a proposition that really works for our customers, as well as the capability of their platform.

“The feedback on FreeAgent’s platform speaks for itself, and when we piloted FreeAgent with our customers the majority said they would recommend us if we were to offer the service in future.

“This sort of endorsement is hard to come by so I’m very excited to see where this partnership can take us.”