The Royal Bank of Scotland Group (RBS) said its board decided not to take forward a proposed AGM resolution submitted by ShareSoc and UK Shareholders’ Association (UKSA) that called for the creation of a shareholder committee.

RBS said that having taken legal advice the proposed resolution “was considered to be inconsistent with the law and the company’s constitution.”

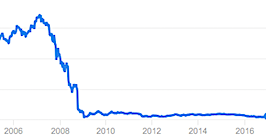

The UK government acquired a roughly 73% stake in RBS at around 503p per share during the 2008 bail out. RBS shares now trade around 226p.

Instead, RBS said it supported the introduction of “formal stakeholder engagement panels, which will allow directors and senior executives to hear directly from a range of key stakeholders, including employees, customers, suppliers and others with an interest in how the company is performing and operating.”

RBS said it envisaged the members of its sustainable banking committee taking the lead in stakeholder engagement as “stakeholder supporters.”

The banking group said it continued to contribute to industry feedback on the Department for Business, Energy and Industrial Strategy’s (BEIS) Green Paper on Corporate Governance Reform “which will address each consultation question posed and explore the more technical considerations connected to the proposals.”

RBS Chairman Howard Davies said: “Acknowledging past mistakes and recognising the part that RBS must play in reform, we continue to develop our culture and priorities.

“Having looked closely at how we can improve and build upon existing arrangements at board level, we believe that RBS would benefit from strengthening the voice of our employees, customers and wider stakeholders.

“Stakeholder representation is hugely important to us; we want to be trusted, respected and valued by all of our stakeholders.

“We thank ShareSoc and UKSA for their input.

“We will continue to engage with all relevant bodies and are committed to embracing and supporting the government’s call for reform, which we believe will enhance engagement across UK industry as a whole.”

It was revealed on December 30, 2016 that more than 100 individual shareholders of RBS — coordinated by shareholder groups ShareSoc and UKSA — had requisitioned a resolution to install a new shareholder committee at RBS to improve corporate governance at the Edinburgh-based financial group.

ShareSoc, the UK Individual Shareholders Society, and UKSA, the UK Shareholders’ Association, said they believed such a move could help avoid a repeat of mistakes that led to the £45 billion state bailout of RBS in 2008.

Mark Northway, ShareSoc chairman, said on December 30: “One objective is to stop the events that took place at RBS from ever happening again.

“A dominant CEO; concealing the true financial position of the company from investors; proceeding with a reckless acquisition; and then publishing a rights prospectus which concealed the problems faced by the company.

“These are not examples of good governance.

“Shareholders, including individuals, deserve a new approach; one with greater involvement and more effective input from them as ultimate owners.”