British insurer Phoenix Group Holdings is in advanced talks to buy Standard Life Aberdeen Plc’s insurance business for about £3 billion and a deal could be announced as early as this week.

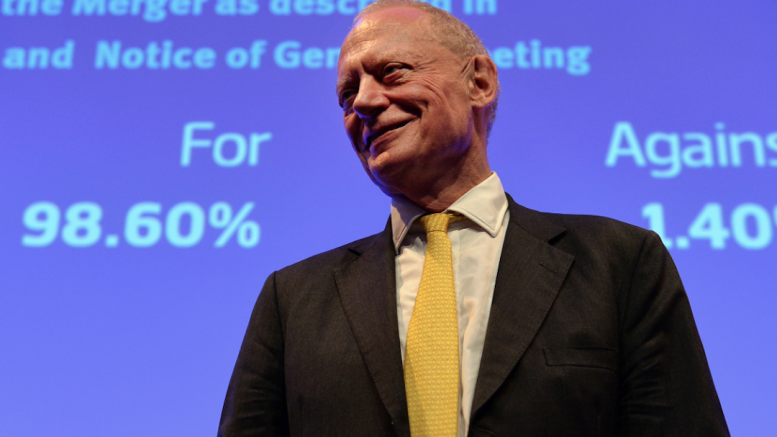

There is also speculation that Standard Life Aberdeen, which announces annual results on Friday, will confirm that chairman Gerry Grimstone will leave the Edinburgh-based investment giant next year once a successor is in place.

No final agreement with Phoenix Group has been reached and the talks could still fall apart.

Phoenix Group plans a capital raise of about £1 billion to pay for the deal.

Standard Life Aberdeen is expected to confirm on Friday it is in talks to sell its insurance unit to Phoenix in a £3 billion cash-and-shares deal.

Under the terms of the transaction, the Edinburgh-based asset manager will take a 20% stake in Phoenix.

Last week, Lloyds Banking Group (LBG) announced it would terminate a contract for Standard Life Aberdeen to manage £109 billion of assets for LBG’s Scottish Widows business.

There had been speculation that LBG and Standard Life Aberdeen had been considering a merger of their life insurance businesses but talks broke down.

Analysts said a deal with Phoenix could remove the main competition hurdle to Standard Life Aberdeen continuing to manage the £109 billion of Widows assets.