Edinburgh-based John Menzies plc, the global airport services firm, said on Thursday it appointed private equity fund manager Christian Kappelhoff-Wulff to its board and formed two new committees to consider strategic options for the company, including M&A deals.

Kappelhoff-Wulff is the founder and chief executive officer of Lakestreet Capital Partners AG, an investment firm based in Zug, Switzerland.

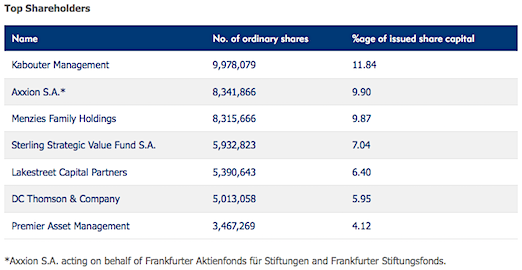

Lakestreet holds a 6.4% stake in Menzies, making it one of the firm’s biggest shareholders.

Kappelhoff-Wulff will chair a new Strategic Committee at Menzies, which “will evaluate all future key strategic decisions, including significant capital investments and any potential future M&A activity.”

John Menzies chairman Dermot Smurfit said: “I am pleased to welcome Christian to the board and look forward to his advice and guidance as we look to seize the opportunities that exist within our markets.

“We continue to progress our plans to grow our business and remain focused on margin progression while delivering excellent customer service.”

Gianluca Ferrari, an analyst with Frankfurt-based investment fund Shareholder Value Management, told Reuters: “The current market valuation of John Menzies is substantially lower than what we have seen in private market transactions and we applaud the board for taking the first concrete steps aimed at closing that gap.”

In a stock exchange statement, Menzies said: “Prior to founding Lakestreet Capital Partners AG, Christian was a director of Goldsmith Capital Partners AG working directly for its founder Clemens J. Vedder for four years.

“Christian brings strong capital allocation and strategic skills to the board.

“Menzies is a pure play aviation services business operating in a structural growth market which offers great expansion opportunities for the group.

“To ensure that these opportunities are pursued and maximised the board has constituted two new committees, namely;

“Strategic Committee … The Strategic Committee will be tasked with keeping under review the delivery of the group’s strategy and structure, and will evaluate all future key strategic decisions, including significant capital investments and any potential future M&A activity.

“The committee members will be Christian Kappelhoff-Wulff (chair), Dermot Smurfit, Giles Wilson and Philipp Joeinig.

“Performance Management Committee … The Performance Management Committee will perform regular reviews of the group’s operations ensuring the attainment of key operational and commercial metrics that drive the business.

“The overall objective is to ensure we continually strive to achieve best-in-class margins through our efficient and productive operations, while delivering excellent customer service which together will drive organic growth.

“The committee members will be Philipp Joeinig (Chair), Giles Wilson, John Geddes and Mervyn Walker.”

On May 17, Menzies said the process to appoint a new chief executive officer of the firm “is progressing as planned and the board is hoping to conclude this process in early June.”

Menzies said in March former CEO Forsyth Black “decided to step down from his role …” and chief financial officer Giles Wilson became interim chief executive.

Menzies’ main business is now Menzies Aviation, a global provider of passenger, ramp and cargo services.

Menzies Aviation operates at more than 200 airports in 36 countries and employs about 32,000 people.

In March, Menzies reported 2018 revenue of £1.29 billion, up from £1.27 billion in 2017, and pre-tax profit of £21.6 million, up from £9.9 million.