Dundee-based investment firm Alliance Trust plc said Willis Towers Watson, its appointed external investment manager, has added Alabama-based Vulcan Value Partners (VVP) to its multi-manager investment strategy, taking the number of stock pickers selected for the Trust up to nine.

Alliance Trust manages assets of around £3 billion and has a stock market value of about £2.6 billion.

VVP is a boutique equity manager based in Birmingham, Alabama, with over $12 billion of assets under management and a 15-strong investment team.

It was established in 2007 by C.T. Fitzpatrick.

Fitzpatrick has over 30 years’ experience and serves as the chief investment officer of the firm — and he will be the lead portfolio manager for the Alliance Trust account.

VVP recently reopened capacity for new investors, having been closed since 2015.

“The new active global equity manager will employ a concentrated, best-ideas approach when picking stocks for the Alliance Trust portfolio and is expected to add a differentiated source of active return, complementing the existing stock pickers within the portfolio,” said Alliance Trust.

As at the end of August, the best ideas from the nine stock pickers produced a portfolio of almost 200 holdings.

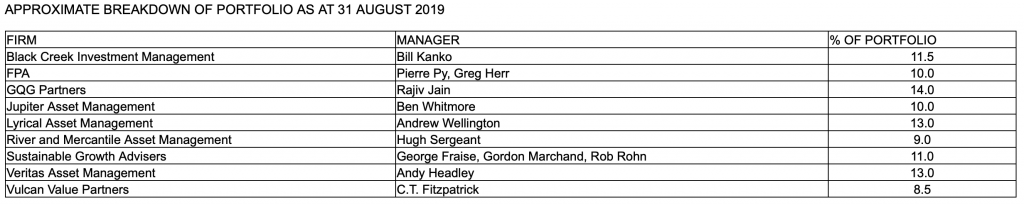

The nine stock pickers are in the table below:

Craig Baker, chairman of the Alliance Trust Investment Committee and global chief investment officer of Willis Towers Watson, said: “Vulcan’s appointment will provide the Trust with access to another highly skilled active manager and will enhance further the portfolio’s diversity and risk control.

“What differentiates Vulcan from other ‘value’ managers is the team’s focus on capital preservation and long-term compounding opportunities.

“The team focus on finding a small number of very high- quality businesses with the ability to compound in value over the long term, that they would want to own if the share prices ever become discounted.

“They then take advantage of market volatility for buying opportunities, instead of being a victim of it. “

“We believe that the best way to deliver long-term outperformance to investors is to combine the best ideas from the best stock pickers globally into one highly active but diversified portfolio and offer it at a competitive fee.”