Aberdeen Standard Investments said on Friday the assets in its Murray International Trust plc fell from £1.73 billion to £1.53 billion in the six months ended June 30, 2020.

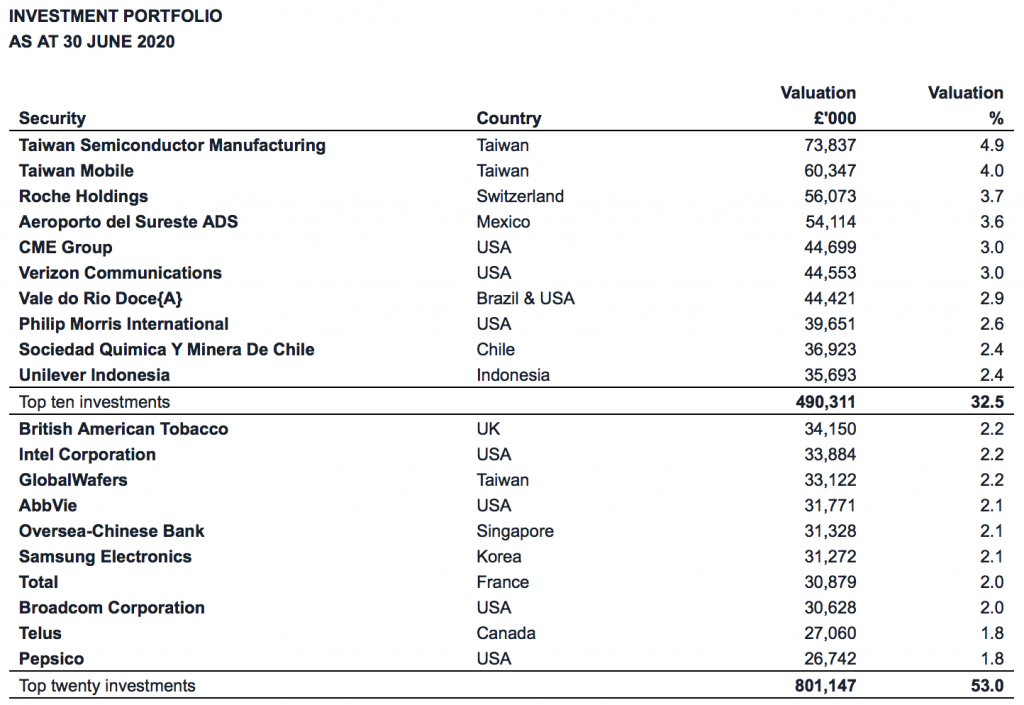

The closed-end fund’s biggest holdings (see graphic below) include a £74 million stake in Taiwan Semiconductor Manufacturing, a £56 million stake in Roche Holdings of Switzerland, a £54 million bet on Aeroporto del Sureste ADS of Mexico and a £45 million punt on CME Group in the US.

The trust’s share price total return fell 18.7% “reflecting a move from trading at a premium of 5.9% to trading at a discount of 3.7%.”

The net asset value (NAV) total return of the fund, with net income reinvested, fell 10.7% compared with a fall of 4.7% for the company’s reference index, which comprises “the return on the FTSE All World TR Index from 27 April 2020 and prior to that the return from the former benchmark which was a composite of 40% FTSE World UK and 60% FTSE World ex UK.”

Despite the numbers, Murray International Trust declared two interim dividends of 12p.

Murray International Trust chairman Kevin Carter said: “As I have stated previously, the board intends to maintain a progressive dividend policy given the company’s investment objective.

“This means that in some years revenue will be added to reserves while, in others, revenue may be taken from reserves to supplement earned revenue for that year to pay the annual dividend.

“Shareholders should not be surprised or concerned by either outcome as, over time, the company will aim to pay out what the underlying portfolio earns.

“The board currently intends in 2020 at least to match the dividend payout of 53.5p per share in 2019.

“It is expected this will entail some use of the significant revenue reserves built up over prior years for occasions such as the current crisis.

“At the end of June 2020 the balance sheet revenue reserves amounted to £69.6m.”

Bruce Stout, the fund’s manager, said: “Fiscal policy responses (to the pandemic) have … been unprecedented …

“Designed to prevent systemic economic collapse, such measures also had significant implications for the performance of stocks and bonds.

“Fixed income yields collapsed across the board, and numerous technology stocks, deemed to be beneficiaries of ‘social isolation,’ soared to unparalleled heights.

“The severity of dividend cuts from companies tackling evaporating revenues and profits has been the deepest on record.

“For global income funds, the backdrop could scarcely have been more difficult …

“Markets are likely to remain volatile for the duration of the year.

“Expectations are for every major economy to contract, contending with slower growth, record low bond yields and companies struggling to achieve meaningful earnings growth, in the short term …

“Portfolio diversification has increasingly proved an unpopular and underwhelming strategy in an investment world with a seemingly insatiable appetite for the ‘Internet of Things’.

“However, as pandemic fears ease and the reality of redemptive policy actions becomes quantifiable, the risk/reward between portfolio concentration and portfolio diversification appears poised to rotate favourably towards the latter.”