Edinburgh-based airport services giant John Menzies plc said in a trading update on Thursday it has recently made “very encouraging commercial progress winning significant new business” despite the coronavirus crisis.

Menzies said its cargo brokerage is trading ahead of expectations.

The company said it has agreed a revised banking covenant structure that “will provide additional flexibility to support the group … as the aviation industry recovers from the impact of the COVID-19 pandemic.”

Menzies said revenue to the half year was down 33% and it will make a loss for the six months, but its second half profitability will benefit “from a more significant contribution by various government support programmes and continuing tight cost management.”

Menzies revealed last month it was spearheading a campaign by the UK’s four biggest air services companies to secure a support package from Westminster to avoid the potential “failure of ground-handling companies.”

Menzies’ shares have fallen about 70% in the past 12 months, taking its stock market value down to around £95 million.

Menzies employed 32,000 globally before the coronavirus pandemic but many staff were placed on furlough.

The Edinburgh-based company operates at more than 200 airports in more than 30 countries for about 500 airlines.

Menzies’ biggest shareholders include the pension fund of Dundee publisher D.C. Thomson & Co.

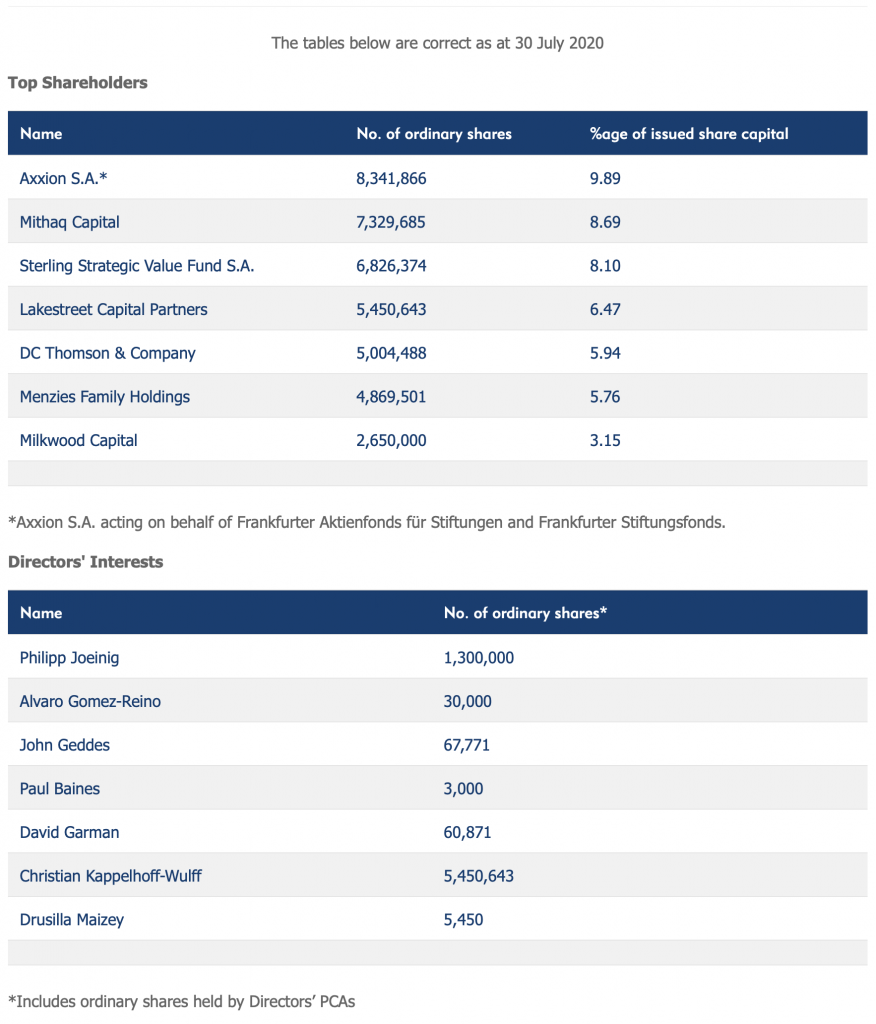

According to Menzies’ website (see below) its biggest shareholder is Axxion SA — acting on behalf of Frankfurter Aktienfonds für Stiftungen and Frankfurter Stiftungsfonds — with 9.89%.

Saudi Arabia-based Mithaq Capital owns 8.69% of Menzies’ stock, Sterling Strategic Value Fund has 8.10%, DC Thomson owns 5.95% and Menzies Family Holdings have 5.76%.

Switzerland-based Lakestreet Capital Partners and its CEO Christian Kappelhoff-Wulff, a Menzies director, own 6.47% of Menzies’ shares.

In its trading update, Menzies said: “As expected, trading has remained challenging due to the ongoing impact of COVID-19, however we are now re-starting operations and seeing a partial return of flight schedules.

“Cargo volumes continue to be more resilient and our AMI business, a cargo brokerage, is trading ahead of expectations given the current lack of available capacity.

“As a result of the very challenging conditions experienced by the industry, revenue to the half year was down approximately 33%, in constant currency, on the prior year.

“The revenue decline has had a significant impact on profitability and will lead to the group being loss making in the first half, although the extent of this has been limited by the speed and effectiveness of our cost management actions.

“In the second half, profitability will benefit from a more significant contribution by various government support programmes and continuing tight cost management.

“Net debt as at 30 June 2020 pre IFRS16 was £160m (£336m on an IFRS16 basis) which reflects the very tight cash management by the business and the benefit of additional government support programmes.

“Despite the crisis we have made very encouraging commercial progress winning significant new business.

“In the first six months we added £27m of net annualised revenue from commercial activities.

“Since the half year end we have won the ground handling and cabin cleaning business of Air France/KLM in Toronto, Canada and further strengthened our relationship with Qatar Airways securing new cargo handling contracts at six locations across three countries together with ground handling contracts at four of these locations.”