Baillie Gifford’s £3 billion Monks Investment Trust plc said on Tuesday it produced a net asset value (NAV) total return of 26.8% compared to an increase of 10.2% for the FTSE World Index in the six months to October 31.

The share price total return for the same period was 25.7%.

Monks’ shares ended the period trading at a premium of 3.5% to the company’s net asset value (NAV).

Monks is managed by Baillie Gifford, the Edinburgh-based fund management group with over £310 billion under management and advice.

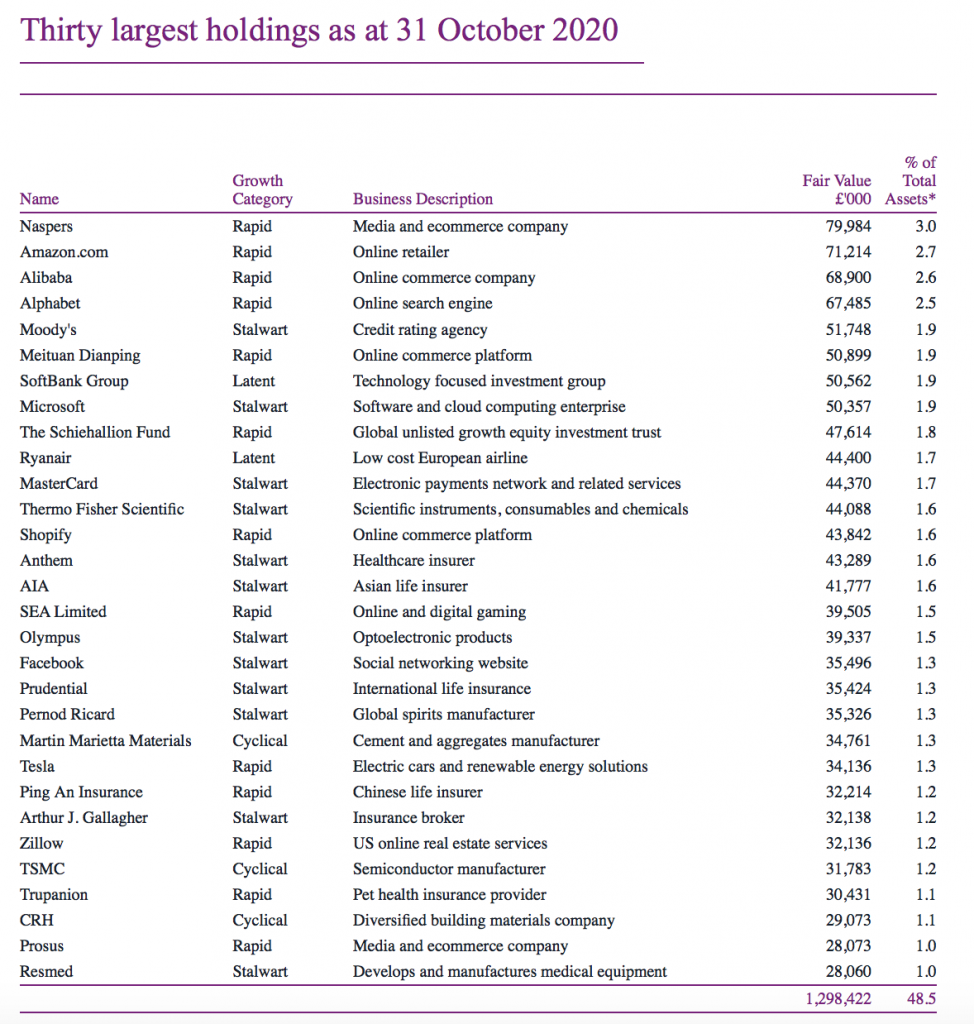

The closed-end fund’s biggest holdings include South African media and internet company Naspers as well as Amazon, Alibaba, Alphabet, Moody’s, Softbank, Microsoft and Ryanair.

“The approach taken by the Monks Investment Trust places significant emphasis on investing in adaptable companies which seek to remain on the right side of change,” said Monks.

“Patient and supportive stewardship is of paramount importance during challenging times.

“In contrast to many market participants, the manager has encouraged companies to forego near-term profitability in the best long-term interests of their stakeholders …

“Since the current team took over management of Monks on 27 March 2015, the NAV total return has been +131.7%, the share price total return +170.8% and the comparative index total return +70.9%.”

Monks is managed by Charles Plowden, Spencer Adair and Malcolm MacColl.

Monks Investment Trust chairman Karl Sternberg said in his report: “Given the choice of possessing any superpower, adaptability would not be top of many people’s lists.

“Indeed, one might rightly question whether it is a superpower at all.

“Teleportation and the ability to fly have featured in numerous box office movies over the years; however, no-one should underestimate the value of adaptability.

“Recent months have highlighted this more than ever: ‘normal’ life has been redefined by the global pandemic.

“It has been heartening amid these challenging times to observe the resilience of many individuals and enterprises as they adapt and respond to changing circumstances.

“The approach taken by the Monks Investment Trust places significant emphasis on investing in adaptable companies which seek to remain on the right side of change.

“By recognising and embracing a diversity of growth types, the Monks portfolio’s resilience lies in its adaptability.

“We remain focused and open-minded as we seek the best growth companies globally, spread across our four growth categories – Stalwart, Rapid, Cyclical and Latent.

“The objective is to build a diversified portfolio that remains resilient through periods of cyclical and structural change and delivers attractive levels of capital growth over the long term …”