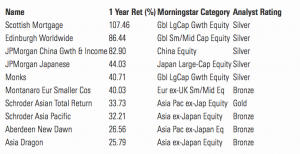

Fund research giant Morningstar has announced that Edinburgh-based Baillie Gifford’s £17.5 billion flagship fund Scottish Mortgage Investment Trust was its best-performing trust of 2020, having achieved gains of 107.46% in its share price.

The managers of Scottish Mortgage are James Anderson and Tom Slater.

Baillie Gifford’s Edinburgh Worldwide Investment Trust came second top in the Morningstar list with an 86.44% gain, with Baillie Gifford’s Monks Investment Trust in fifth place with 40.71%.

“The Silver-rated trust (Scottish Mortgage)is known for its large stakes in disruptors and its penchant for tech stocks, areas which thrived amid a world of lockdowns, home-schooling and remote working,” wrote Morningstar.

“Some 10% of the trust’s assets are invested in electric car maker Tesla, whose shares soared an incredible 700% in the year.

“The rest of its top 10 holdings list is also decidedly well-placed to benefit from the Covid-19 era, including the likes of e-commerce giants Amazon and Alibaba, fast food app Delivery Hero and biotech outfit Illumina.

“And while 2020 was undoubtedly a strong year for the trust, its longer-term track record is no different, with annualised returns of 25.35% over 10 years.”

James Budden, director of marketing and distribution at Baillie Gifford, told Morningstar: “Scottish Mortgage and Edinburgh Worldwide saw spectacular rises in their respective share prices during 2020.

“All this makes sense once one examines the effects of lockdown measures – more e-commerce, more food delivery, more online entertainment, more online communication for work and school, an emphasis on healthcare and more computing power required to make this all work.

“These themes are well represented within stocks held by our trusts.”