London-listed investment vehicle AssetCo plc said on Monday that a “concert party” of Martin Gilbert, Peter McKellar, various associates and funds managed by Toscafund Asset Management have acquired 29.8% of the issued share capital of the company at 475p per share.

Gilbert is former co-CEO of Standard Life Aberdeen (SLA) and McKellar is former global head of private markets at SLA.

Shares of AssetCo plc soared 80% to around 850p on the news.

Gilbert bought a 9.9% stake in AssetCo for roughly £3 million, equal to 650,000 shares at 475p each, while McKellar paid around £1 million for a 3.4% stake.

Gilbert said AssetCo “can be a platform to make strategic investments across the sector and to bring active management to such opportunities.”

AssetCo said: “Following receipt of the necessary regulatory approvals, it is expected that Martin Gilbert and Peter McKellar will join the board as non-executive directors of the company.

“Tudor Davies, Christopher Mills and Mark Butcher will remain as directors of the company.

“The existing strategy of the business will remain and the board, when enlarged, will pursue additional investment opportunities, particularly in the financial services sector.”

Gilbert said: “We believe that the next few years will see significant investment opportunities in the financial services sector as some of the pressures that the industry faces from regulation, fee pressure, technology and changing client preferences force further, and arguably a faster pace of change.

“We believe that AssetCo can be a platform to make strategic investments across the sector and to bring active management to such opportunities.”

AssetCo added: “AssetCo plc announces that Martin Gilbert, Peter McKellar, various associates and funds managed by Toscafund Asset Management, a multi asset fund manager, have, in aggregate, acquired a minority stake of 29.8% of the issued share capital of the company at 475 pence per share, which is approximately the estimated net asset value per share, from a number of institutional shareholders and the board.

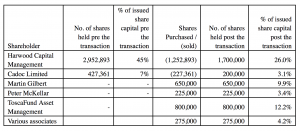

“Below is a table showing the resultant holding of Harwood Capital Management (by virtue of its association with Christopher Mills), Cadoc Limited (by virtue of its association with Tudor Davies) and members of the concert party.”