Shares of John Menzies plc, the Edinburgh-based global airport services business, rose about 8% on Tuesday after it published a trading update for the year ended December 31, 2020.

Menzies said that while revenues were 37% below the prior year, activity levels “showed an encouraging recovery through the third quarter” and it generated an underlying operating profit in the second half of the year which was in line with the board’s expectations.

Menzies share have fallen more than 40% over the past year.

The firm said on Tuesday it has secured a new licence that will see its entry into Cyprus and received confirmation that its new joint venture in Iraq will start operations in January.

Last month, Menzies announced the acquisition of a 51% shareholding in Royal Airport Services (RAS), a leading aviation services business based in Pakistan.

Menzies operates at about 200 airports in more than 30 countries for about 500 airlines.

Menzies said: “Whilst market conditions have remained volatile and challenging during the second half, the board is pleased to report that the group has continued to trade in line with the expectations set out in the group’s interim results on 29 September 2020.

“Revenues for the second half were similar to those reported in the first half and for the full year were 37% below the prior year.

“In the second half, activity levels showed an encouraging recovery through the third quarter, after the very severe reduction in the second quarter.

“Towards the end of the period activity levels declined as a result of normal seasonal factors, as well as the impact of further Covid-19 travel restrictions.

“Ground and fuelling service volumes ended the year 50% below the prior year.

“Revenues from air cargo services were more resilient with volumes c20% below 2019 levels and strengthened by higher yields.

“As anticipated, in the second half, the group generated an underlying operating profit which was in line with the board’s expectations.

“As previously guided, this second half performance was driven by increased volume, a significant contribution from various government support programmes, the positive impact of continued effective cost management and a proactive flexible approach to operations.

“Despite the extremely challenging conditions in 2020, the group has successfully managed its financial position, and as a result, our liquidity is strong coming into 2021.

“Although as previously disclosed, as market conditions and activity levels have improved there has been some working capital outflows in the second half that is expected to continue into 2021.

“Following a very strong cash inflow during the first half and a disciplined approach to cash management during the second half, the board is pleased to report that both net debt and liquidity ended the year favourable to expectations and well above the minimum liquidity covenant.

“During 2020, we successfully renewed several key contracts and recorded a number of important contract wins in both air cargo and ground services, including the deepening of our relationships with Qatar Airways, Wizzair, Loganair and Jetstar.

“We have also been working with customers to improve our reimbursement for excess costs incurred during the crisis.

“The group has made good progress with its growth strategy of diversifying our product portfolio and entering emerging markets with the acquisition of a 51% stake in Royal Air Services (RAS) a ground and air cargo services provider at eight airports across Pakistan.

“This acquisition creates a strong platform for Menzies in this attractive growth market and represents clear delivery against the company’s strategic objectives of increasing depth of service capability and expanding its geographical footprint.

“We have also secured a new licence that will see our entry into Cyprus and confirmation that our new joint venture in Iraq will commence operations in January.”

In its outlook, Menzies said: “We continue to believe market conditions will remain challenging through the early part of 2021, and this is reflected in the group’s operational and financial assumptions.

“While there has recently been some renewed Covid-19 related disruption, the positive developments with regard to the roll out of vaccination programmes are encouraging and support assumptions of a gradual recovery in volumes from the second quarter of 2021.

“Assuming a more stable, if still subdued, backdrop in 2021, the actions taken to structurally reduce costs, should show an increasing benefit in the current year, with government support schemes also continuing to provide a material benefit in the first quarter.

Over the medium to long term, the board expects that the benefits of the reduced cost base, together with the ongoing good commercial momentum will contribute to structurally improved operating margins and consistent cash generation.

“This will enable the group to both reduce its leverage and take advantage of selective strategic opportunities that may arise.

“Overall, the board remains confident in the medium and long-term growth potential of the aviation services market and believes that, as the global aviation market recovers, John Menzies plc, as a well- invested global leader, is well positioned to take advantage of the pipeline of organic and inorganic opportunities that exist.”

Menzies chairman & CEO Philipp Joeinig said: “I see the opportunities for the business as being stronger than ever.

“I am pleased that we have not wasted this crisis, having instead used it to become more competitive.

“We are well on track with our rebased growth strategy and we are moving in the right direction towards being the service provider of choice to our customers.”

Menzies’ biggest shareholders include the pension fund of Dundee publisher D.C. Thomson & Co.

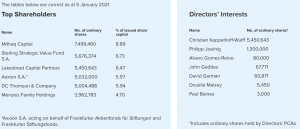

According to Menzies’ website (see below) its biggest shareholder is Saudi Arabia-based Mithaq Capital with 8.89% of Menzies’ stock.

Sterling Strategic Value Fund SA has 6.73%, Axxion SA — acting on behalf of Frankfurter Aktienfonds für Stiftungen and Frankfurter Stiftungsfonds — has 5.97%, DC Thomson owns 5.94% and Menzies Family Holdings have 4.7%.

Switzerland-based Lakestreet Capital Partners and its CEO Christian Kappelhoff-Wulff, a Menzies director, own 6.47% of Menzies’ shares.