Scotgold Resources Limited, the Australia-based gold exploration firm focused on Scotland, announced it has converted loans from four directors into shares in the company.

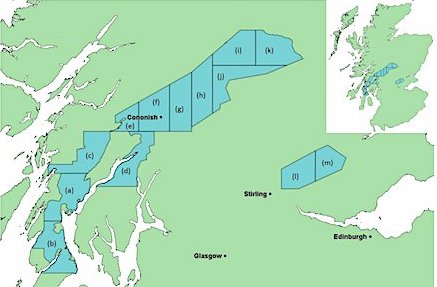

On September 1, Scotgold announced it is looking to build the company’s workforce at its Cononish Gold and Silver Project amid a “significant improvement” in its production profile.

On April 30, the company said some of its directors agreed to provide a short term loan of up to £2 million to ensure the company had adequate funds available for working capital through a production ramp up period.

Scotgold said on Monday: “In light of the significant operational progress made this year, the participants in the director loan expressed their willingness to convert the loan into equity.

“The directors took the view that conversion was in the best interests of the company and all the shareholders.

“Relieved of its obligation to repay the loan in November 2021, the company will have significant additional cash resources.

“These will be used in the immediate term to further de-risk operational processes and accelerate optimisation of the mine and process plant.

“The company’s operational performance is on track to achieve the targets for September in line with previous announcements.

“The DUX truck arrived as planned, mining has continued in the cut and fill stope area and the process plant is expected to produce between 50 and 75 tonnes of concentrate.”

Scotgold CEO Phillip Day said on Monday: “This a clear signal to the market of the board’s continued commitment to the success of Scotgold, and also to their confidence in our combined ability to generate real returns for our shareholders.

“The agreement of this short-term loan in May came at a time when the management were addressing a number of operational challenges as part of the ramp up of our Cononish Gold-Silver Mine in Scotland, with the funds used judiciously to continue this process with a view to achieving targeted design processing capacity.

“As communicated in my monthly operational updates, this process has been successful, and we are on track to achieve monthly operating targets.

“Today’s settlement and conversion is an important development for Scotgold, and I look forward to continuing this forward momentum by building on our operational successes and enhancing our financial performance over the coming months.”

On details of the conversion, Scotgold said: “… the company is pleased to announce that it has agreed to the settlement of the amounts owed by SGZ Cononish Ltd, a wholly owned subsidiary of the company, under the short-term loan funding provided to the company by certain directors of the company, being Nathaniel le Roux, William ‘Bill’ Styslinger, Peter Hetherington and Ian Proctor, together with an unrelated third party by the issuing of 3,301,420 new ordinary shares of no par value each in the company at a price of 60.58p per new ordinary share …

“The loan settlement share price of 60.58p represents a 15.07% discount to the volume weighted average price (VWAP) of the ordinary share for the last 30 trading days.

“The 15.07% discount is the average discount for equity issues for cash by AIM basic materials companies over the five month period ending 31 August 2021.”