Edinburgh-based Stamp Free Limited, the digital postage company, said it raised £600,000 in an oversubscribed funding round as the business makes progress towards the commercial launch of its AI phone-based alternative to traditional mailing and returns.

Investment was led by existing investors Silicon Valley-based R42 Group and Cambridge Angels along with other technology angel investors from the UK, US and Australia.

In this latest investment round, Stamp Free said it raised £600,000 at a pre-investment valuation of £4 million – double the £2 million pre-investment valuation of the company’s Seed One funding round in September 2021.

“This increase reflects the significant progress made by the company in recent months, with its solution now being trialled by postal carriers, retailers and locker providers in different geographic locations around the world,” said Stamp Free.

“Stamp Free expects the solution to be available for consumers later this year.

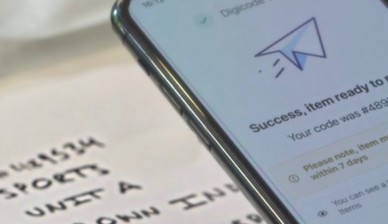

“The Stamp Free Digital Postage Solution allows businesses and consumers to use the Stamp Free or white-labelled app to send parcels and letters, as well as return consumer goods, without the need for a postage stamp or carrier label.

“Utilising machine handwriting recognition as a core part of its technology, Stamp Free also benefits postal carriers by removing issues associated with postage stamps such as fraud, liabilities and the cost of printing.

“It is also beneficial for the environment with no extra machinery, stamps or printed postage labels required — just handwritten six or eight-digit codes, essentially handwritten barcodes — which are scanned and validated by AI at the source by a smartphone before the mail item is sent or returned.”

Stamp Free MD Hugh Craigie Halkett said: “This investment signifies a further endorsement of the Stamp Free solution, which is poised to disrupt the postal and logistics industry.

“We’ve made excellent progress since our last funding round, commencing trials with postal carriers, retailers and locker providers around the world, and this new raise will accelerate our development.

“We thank our existing investors for their continued support and welcome our new investors to our journey.”