NatWest-RBS has announced that it will immediately stop all reserve-based lending for new customers financing oil and gas exploration and extraction, before phasing it out entirely by the end of 2025.

A NatWest spokesperson told Reuters the bank would still honour reserve-based lending contracts entered by existing customers before the end of 2025 until they expire.

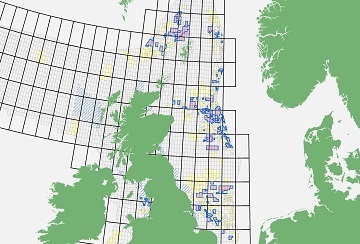

NatWest is not a major player in energy lending but it is the UK’s biggest business bank, and has exposure to companies operating in Western Europe and the North Sea.

“… from today, we will not provide reserve based lending specifically for the purpose of financing oil and gas exploration, extraction and production for new customers, and, after, the 31st December 2025 we will not renew, refinance or extend existing reserve based lending specifically for the purpose of financing oil and gas exploration, extraction and production,” said NatWest CEO Alison Rose.

“I hope this sends a strong signal that we are serious about ending the most harmful activity whilst financing the transition …

“The analysis of our lending and investment book will link to our ambition to halve the climate impact of our financing activity …

“We know that in some areas we can take action ourselves but in others we are dependent on government policy.

“This vital partnership between the public and private sectors is the key to unlocking the challenge of our lifetime at pace and scale.”