The Scottish Government said on Wednesday that Scotland’s “notional deficit” under the current constitutional position as part of the UK has continued to fall “at a faster pace than the UK’s” — driven by record North Sea oil and gas revenues and “strong growth in the tax take.”

It said figures for the 2022-23 financial year show total revenue for Scotland increased by £15 billion or 20.7% “compared with 11.3% for the UK as a whole.”

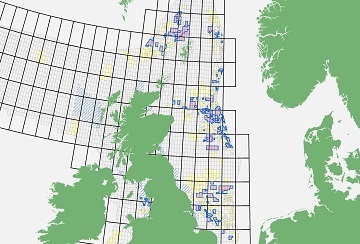

Scottish public sector revenue was estimated at £87.5 billion. Of this, £9.4 billion was North Sea revenue, up from £2.4 billion in 2021-22, following the introduction of the Energy Profits Levy.

Total expenditure “for the benefit of Scotland by the Scottish Government, UK Government and all other parts of the public sector” was £106.6 billion.

“Social protection” made up 27.5% of the spending.

Scotland’s “net fiscal balance” under the current constitutional position as part of the UK was a deficit of £19.1 billion or 9% of GDP. This is down from 12.8% of GDP in 2021-22 and 23.4% in 2020-21. For the UK, the deficit was 5.2% of GDP.

All the estimates are included in the latest edition of the highly contentious and controversial Government Expenditure and Revenue Scotland (GERS) statistics.

Revenue per person in Scotland was £15,967 — £696 higher than the UK average and the first time it has been higher since 2014-15. Expenditure per person for Scotland was £19,459 — £2,217 higher than the UK average.

Spending in Scotland increased by £9.3 billion or 9.5% “reflecting increases in reserved public sector debt interest payments, which are linked to inflation, and the introduction of Cost of Living support.”

The estimates include a £1.9 billion increase in revenue from Scottish income tax and the £6.9 billion increase in North Sea revenue.

The Scottish Government said these increases were partially offset “by a rise in spending on cost of living measures and interest payments on UK Government debt.”

Total devolved tax revenue in 2022-23 was estimated at £21.3 billion.

Neil Gray, Cabinet Secretary for Wellbeing Economy, Fair Work and Energy, said: “I am pleased that Scotland’s finances are improving at a faster rate than the UK as a whole, with revenue driven by Scotland’s progressive approach to income tax and our vibrant energy sector.

“While the record revenues from the North Sea show the extent that the UK continues to benefit from Scotland’s natural wealth, these statistics do not reflect the full benefits of the green economy, with hundreds of millions of pounds in revenue not yet captured.

“It is important to remember that GERS reflects the current constitutional position, with 41% of public expenditure and 64% of tax revenue the responsibility of the UK Government.

“Indeed, a full £1 billion of our deficit is the direct result of the UK Government’s mismanagement of the public finances.

“An independent Scotland would have the powers to make different choices, with different budgetary results, to best serve Scotland’s interests.

“While we are bound to the UK’s economic model and do not hold all the financial levers needed, we will continue to use all the powers we do have to grow a green wellbeing economy, while making the case that we need independence to enable Scotland to match the economic success of our European neighbours.”

David Phillips of the UK’s Institute for Fiscal Studies (IFS) wrote: “As part of the UK, Scotland’s notional fiscal deficit is subsumed within the wider UK fiscal deficit. Under independence, that would change.

“The Scottish Government’s Medium-Term Financial Strategy (and our analysis of that report and Scotland’s longer-term funding outlook) show that Scotland faces tricky decisions on tax and spending within the Union.

“These GERS-based projections remind us that independence would be no panacea for this issue – indeed, Scotland’s larger notional fiscal deficit means that unless economic growth and hence tax revenues were boosted, tax rises or spending cuts would likely need to be even larger in the years ahead.

“Scotland has experienced periods where growth in employment, earnings and the economy as a whole has consistently outpaced that of the UK as a whole – during the 2000s, for example, as our recent report highlighted – and could do so again in future, especially if long-standing issues with productivity and skills can be tackled.

“But Scotland will also face tricky headwinds in the years ahead as declines in the oil and gas sectors hit onshore as well as offshore tax revenues, and more rapid ageing of the population affects tax and spending.

“Such issues are at the heart of debates about independence not just because they relate directly to people’s jobs and salaries, but because they also have an important bearing on Scotland’s public finances, and hence the taxes people could pay and the services they could expect to enjoy post-independence.”

The IFS says it is “non-political” and that it receives funding “from a range of sources, including the Economic and Social Research Council, UK Government departments, foundations, the European Research Council, international organisations, companies and other non-profit organisations.”

CBI Scotland Director Tracy Black said: “Record North Sea revenues have provided a welcome uplift and showed the oil and gas sector’s continued importance to Scotland’s fiscal position.

“The ending of the Scottish Government’s COVID support for business through non-domestic rates, announced in late 2021, has also impacted on the overall balance sheet.

“Higher public spending has been necessary to help households and businesses weather rising energy and other costs since the Ukraine conflict began, but much more work is needed to support growth in the private sector.

“Providing the right framework for businesses to thrive by attracting and training the best talent is vital. This can be achieved by removing planning constraints, particularly for renewables and making improvements to infrastructure and connectivity.

“The First Minister’s inaugural Programme for Government in a few weeks’ time will be crucial to building business confidence and sustainable growth which are key to Scotland’s economic success.”