Chevron is planning to sell its remaining UK North Sea oil and gas assets in a move that would mark the US energy giant’s exit from the ageing basin after more than 55 years, Reuters reported.

The sale could raise up to $1 billion excluding tax benefit. The process is expected to be formally launched in June, industry sources told Reuters.

Chevron said the North Sea sale is not related to the 35% windfall tax the UK government imposed on North Sea producers following the surge in energy prices in 2022.

“As part of Chevron’s focus on maintaining capital discipline in both traditional and new energies, we regularly review our global portfolio to assess whether assets are strategic and competitive for future capital,” said Chevron.

The planned sale comes as Chevron prepares for the $53 billion acquisition of Hess — which it previously said will include $10 billion to $15 billion in asset sales around the world.

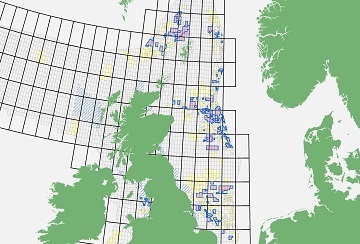

Chevron’s remaining assets in the UK North Sea include a 19.4% stake in the BP-operated Clair oilfield west of Shetland, the largest in the British North Sea with production of 120,000 barrels per day.

Chevron is also seeking to sell its marginal interests in the Sullom Voe oil terminal, as well as its stakes in the Ninian and SIRGE pipeline systems, which are both linked to the hub.

The sale will not impact the operations of Chevron’s international headquarters in London or its technology centre in Aberdeen.

In 2018, Chevron sold its stake in the Rosebank field development to Equinor. A year later it sold many of its North Sea assets to Ithaca Energy.

“Chevron continues the trend that has seen the North American majors seek to exit the UK,” said David Moseley, analyst at consultancy Welligence.