Aberdeen-based Faroe Petroleum on Tuesday urged its shareholders to reject a £608 million hostile bid from Norwegian oil and gas company DNO, saying the offer “is opportunistic and substantially undervalues Faroe.”

DNO, which has built up a 28.22% stake in Faroe, on Monday offered 152p per share in cash for the Aberdeen firm.

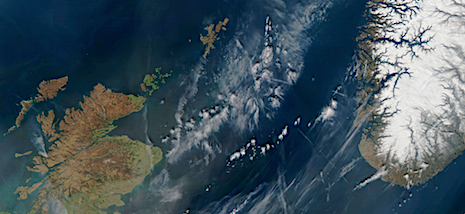

Faroe operates in the UK North Sea and Norway’s North Sea.

Other big shareholders in Faroe include Black Rock Investment Management, Aviva Investors and Invesco Perpetual.

Since the bid was made, Faroe Petroleum shares have surged about 25% to around 157p, indicating a higher offer may be required.

Faroe chairman John Bentley said: “DNO’s offer substantially undervalues Faroe on every applicable metric.

“The board is determined to defend our shareholders’ rights to receive an appropriate premium for a fully funded business which is actively progressing the delivery of its highly attractive growth prospects and is the only platform available which solves DNO’s strategic challenges.

“We believe that Faroe is worth substantially more than 152p per share and we urge shareholders to reject DNO’s opportunistic, unsolicited and inadequate offer.”