Aberdeen-based Faroe Petroleum on Thursday issued a circular rejecting a hostile £610 million cash takeover bid from Norwegian oil and gas company DNO.

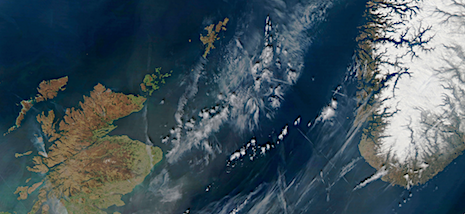

Faroe operates in the UK North Sea and Norway’s North Sea.

Faroe urged its shareholders to reject DNO’s “opportunistic, unsolicited and inadequate offer” and do nothing.

Meanwhile, DNO bought another 914,732 shares in Faroe at 151.6 pence each, taking DNO’s shareholding in Faroe to about 28.47%.

“The board of Faroe announces that it is today publishing its response circular in relation to the unsolicited offer for the entire issued and to be issued share capital of Faroe not already owned by DNO ASA at 152p per share in cash,” said Faroe.

“The board reaffirms its previous statements that the offer is opportunistic and substantially undervalues Faroe, and encourages all shareholders to take no action.”

Faroe chairman John Bentley: “It is your board’s strong belief that this offer is entirely opportunistic and that the terms fundamentally undervalue Faroe.

“We have one of the best exploration track records on the Norwegian Continental Shelf and are currently in the midst of the largest drilling campaign in Faroe’s history.

“We are fully funded to deliver our 35,000 boepd production target in the near-to-medium term and are confident in our ability to deliver in excess of 50,000 boepd in the medium term.

“We have an excellent track record of actively managing our portfolio as demonstrated most recently by the Equinor asset swap which will add £96 million incremental cash flow in the next two years.

“DNO were not aware of this transaction when they announced their offer and have since then failed to revise their offer to reflect the significant benefits created by it.

“As a result of the Equinor asset swap, we are now able to give careful consideration to the optimal mix of: reinvestment into the existing portfolio given the significant growth opportunities therein; pursuing value accretive M&A opportunities leveraging our reputation as a credible and reliable counterparty; and returning capital to shareholders.

“Your board unanimously recommends that you should reject the offer.”

Bentley’s letter to shareholders is available on https://www.fp.fo/