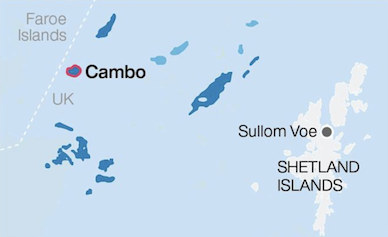

Shell has launched a sale process for its 30% stake in the Cambo oil prospect west of Shetland in the UK North Sea, potentially paving the way for the field’s controversial development, according to a Reuters report.

She has hired investment bank Jefferies to run the sale process for the stake in Cambo, which has become a lightning rod for climate activists seeking to halt the development of new oil and gas resources, Reuters reported.

Cambo is the second-largest undeveloped resource in the North Sea.

It is operated and 70%-owned by Ithaca Energy, which is owned by Israel’s Delek Group.

Last month, Shell CEO Ben van Beurden said he could not see Shell taking part in Cambo because its “economics are simply not supportive enough”.

A new owner for the stake will most likely support the field’s development, the Reuters report said.

Ithaca, which took ownership of the field after acquiring rival Siccar Point for $1.1 billion in April this year, said the prospect was economically viable.

Ithaca CEO Alan Bruce said in April the development of the Cambo and Rosebank fields is a “huge opportunity to not only help secure the UK’s energy future for at least another quarter of a century, but also to create thousands of direct and indirect jobs in the process.”

Ithaca chairman Gilad Myerson told Reuters Cambo could deliver up to 170 million barrels of oil during its 25-year operational life.