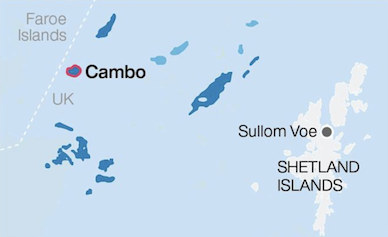

Israeli energy conglomerate Delek Group announced that its North Sea subsidiary Ithaca Energy has acquired Siccar Point Energy — which owns 70% of the controversial Cambo oilfield west of Shetland — for almost $1.5 billion.

Ithaca Energy CEO Alan Bruce said the development of the Cambo and Rosebank fields is a “huge opportunity to not only help secure the UK’s energy future for at least another quarter of a century, but also to create thousands of direct and indirect jobs in the process.”

A spokesperson for Shell, which owns a 30% stake in Cambo, said it had nothing to add to its statement in December, when it withdrew from the project.

Ithaca Energy said: “The consideration of the agreement includes an upfront payment of USD 1.1 billion and a series of contingent payments totalling a maximum of USD 360 million (USD 300 million linked to future developments and USD 60 million linked to short term realised commodity prices).

“The Siccar Point team and operatorship of key UK assets will transfer to Ithaca on closing, further enhancing the company’s established operating capability …

“The addition of the Schiehallion and Mariner fields, both currently in the top 10 UK producing fields, will not only add immediate production but also add significant room for growth through future drilling.

“Also included is an interest in the producing Jade gas field, where Ithaca is an existing partner, offering further near-term drilling exposure.

“The transaction will also include the Cambo and Rosebank fields, two of the largest undeveloped and most strategically important discoveries in the UK North Sea.

“The acquisition of Siccar Point’s assets across the West of Shetland, Northern North Sea and Central North Sea, will add significant production, material growth potential, and a long-life cycle to the company’s portfolio.

“The acquisition will also double Ithaca’s recoverable reserves and support production of at least 80,000 – 90,000 boe/d through the next decade, with the potential to increase this through further portfolio opportunities.”

Ithaca CEO Bruce added: “This is a transformational deal for the company which cements Ithaca’s position as a leading independent E&P operator in the North Sea.

“The acquisition doubles our recoverable resources and means that we now have interests in a significant portion of the largest UKCS fields.

“This includes interests in two of the UK’s most strategically important and near-term developments which will enable us to play an increasing role in securing domestic energy supply for the UK.

“This enlarged portfolio will underpin production of 80-90kboe/d for the next decade, with the potential for further growth through low-risk drilling.

“We firmly believe that this transaction will deliver value for all of our stakeholders including the local community and wider UK economy.

“The development of the Cambo and Rosebank fields is a huge opportunity to not only help secure the UK’s energy future for at least another quarter of a century, but also to create thousands of direct and indirect jobs in the process.

“We are excited about the future for the enlarged Ithaca, the role we will play in the UKs energy supply, and look forward to welcoming our new colleagues from Siccar Point.”