Offshore Energies UK (OEUK) has called for a “rapid acceleration of investment” into North Sea oil, gas and offshore wind — and a prompt announcement of the next round of North Sea exploration licences.

The OEUK published its “Economic Report: A Focus on UK Energy Security” on Wednesday.

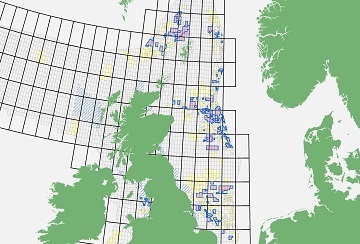

The report said the UK’s surrounding seas still contain energy reserves equivalent to 15 billion barrels of oil – enough to fuel the UK for 30 years.

The report urges an action plan focused on a “rapid acceleration” of investment into such resources.

It said this should include announcing the next round of North Sea oil and gas exploration licences as soon as possible alongside a rapid expansion of offshore wind.

The UK government’s key aim, said the report, must be to maximise the UK’s energy independence and reduce its vulnerability to further global price shocks and shortages.

The report also analyses the cumulative impacts of rising global gas prices on UK consumers.

It estimates that UK domestic consumers’ annual gas and electricity bills will have risen from about £32 billion in 2021 to around £100 billion once the next round of price rises takes effect in October.

More price rises are predicted in 2023.

The impact of global price rises on UK business is similar.

The report said: “Businesses are even more exposed to changes in [global] gas prices as there is no protective price cap in place for non-domestic energy use …

“If it was to be assumed that average spend this year was to treble (roughly the same rate of increase as the domestic price cap) then overall spend on electricity and gas by industry and businesses could rise to £108bn, from £36bn last year.”

The report said the UK could face potential energy shortages and high prices this winter and warns that global prices could remain high for at least three years.

The report also welcomes the government’s announcement of a review of the UK’s electricity markets. At the moment UK electricity prices are based on the cost of gas.

“This is because gas is used to generate 40% of UK power, the biggest single source,” said OECD.

“It means that gas power costs set the national price for electricity. So, when gas prices rise, electricity prices rise too.

“However, this also means that power from other generators, including those based on nuclear and renewable, increases too – even though their costs had not changed.”

The report said: “We need to see reform of the electricity market to ensure that the falling cost of renewable power is also passed on to consumers.”

OEUK’s acting CEO Mike Tholen said: “Our report is a red alert for UK energy security.

“Today 24 million UK homes are heated by gas boilers; 30-plus gas-fired power stations produce about 40% of our electricity, and we have 32 million vehicles running on diesel and petrol.

“The UK’s homes and businesses cannot yet do without these fuels, but Putin’s war in Ukraine shows the risks of relying on other countries for energy.

“Our North Sea reserves mean the UK can protect itself – provided we invest – as well as building the low-carbon systems for the future …

“It means we must expand the supply of low carbon energy including wind and hydrogen but the scale-up will take time. UK gas will give us a bedrock of reliable energy through the transition and minimise reliance on imports.

“In practical terms we need the new government to rapidly announce the next round of oil and gas exploration licenses and speed up production approvals.

“We are also encouraging the UK government’s focus on tariff reform. Right now, our energy markets are being controlled by President Putin who is driving up the price of gas to break ours and Europe’s resolve over Ukraine.

“We cannot let that continue. We need to move away from a system that allows the price of gas to control the cost of electricity.

“This is also important for our ambition of moving towards low-carbon energy where our power comes increasingly from renewables and nuclear.”

Ross Dornan, OEUK’s market intelligence manager, said: “The best way for the UK to ensure secure gas and oil supplies is by increased investment in its own resources. Without that, the UK will be increasingly reliant on imports.

“Electricity prices have historically been linked to the cost of gas, but power is increasingly generated by multiple sources besides gas. That includes a growing proportion of renewables – the price of which is falling.

“Basing electricity prices entirely on the price of gas is no longer necessary and is damaging for consumers.”