Shares of Scotgold Resources Limited, the Australia-based gold exploration company focused on Scotland, fell another 20% on Tuesday after it published a stock exchange statement saying it “expects production for calendar year 2021 to be materially less than the guidance range previously announced …”

Scotgold also said it is “investigating financing options, including short-term debt financing from the directors.”

The firm said recent delays to its production ramp-up “have had and are expected to have a negative impact on the company’s cash position.”

Scotgold shares trade on the London AIM market, where they fell another 20% on Tuesday. For the year to date, the firm’s shares are down about 40%.

Scotgold’s biggest shareholder with 40.23% is chairman Nat le Roux, according to the firm’s website.

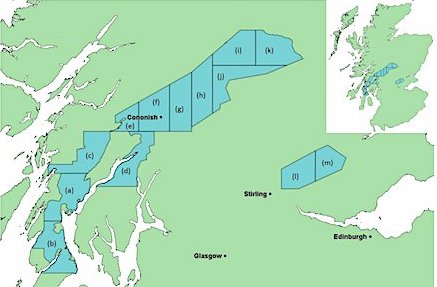

“Scotgold announces an update to the market with regard to its mine production and processing expectations for the Cononish Project and the associated working capital requirements arising from these …” said Scotgold.

“The company commenced a review of the mine plan for Cononish at the beginning of April 2021 and it has been concluded that the ramp up of underground mining production will be slower than originally planned.

“Mine development is insufficient for the mine to provide optimal ore quantity and quality in the short term, however this is not predicted to have long term impacts.

“The mine team at Scotgold has undergone a reshuffle in leadership and approach to ensure it can deliver reliable and robust short term mine plans.

“Accordingly, the company expects production for calendar year 2021 to be materially less than the guidance range previously announced on 31 March 2021.

“A further update in connection with the ramp-up of production, including new estimates for ore to be processed and gold to be produced for the calendar year 2021 will be announced as soon as the company has completed the review of the mine plan for Cononish.

“The recent delays to the production ramp-up have had and are expected to have a negative impact on the company’s cash position.

“To ensure the company has adequate funds available for working capital through this production ramp up period, the company is investigating financing options, including short-term debt financing from the directors.

“A further update will be made to shareholders in due course.”