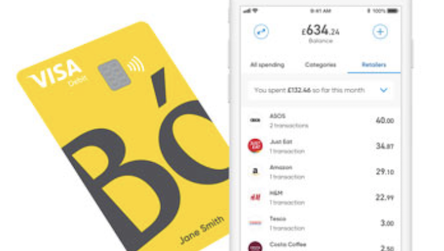

Royal Bank of Scotland group’s NatWest has launched its standalone digital bank Bó in a plan to meet competition from online start-ups.

The Bó app is designed to encourage people to budget better.

It will target the 16.8 million British consumers with savings of less than £100.

RBS is still still majority state owned after a bailout in the 2008 financial crisis and its biggest brand NatWest has 16 million customers.

Bó chief executive Mark Bailie said: “In this digital, contactless age, people need support managing their money more than ever.

“It is all too easy to lose control.

“Our data suggests that three quarters of people in the UK are living financially unsustainable lives.

“We want to help change this.

“We are launching Bó to help people build the habits and routines that will allow them do money better day-by-day and week after week so they can fund their lives and lifestyles in a more sustainable way.

“As we’re part of NatWest, people can rely on Bó to keep their money safe.

“But as a digital bank, built entirely on a separate cloud-based technology, Bó is also able to harness new technology and develop rapidly in line with our customers’ needs and expectations.

“With Bó we have an opportunity to help address a genuine societal need and to be a positive force in our customers’ lives.

“Our aim is to transform the nation’s attitudes and behaviour around money and I’m hugely excited to see what we can achieve.”

Bó analyzed 1.5 billion pieces of NatWest data to help understand spending habits.

“We’ve got a big data set, and the data set says that customers have a broken relationship with money,” Bailie said.