Shareholders of Standard Life and Aberdeen Asset Management both voted overwhelmingly to approve the £11 billion merger of the Scottish investment giants on Monday.

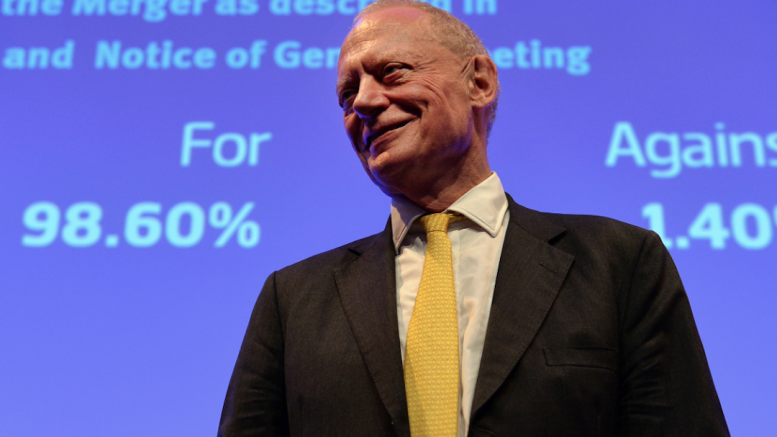

About 95.8% of Aberdeen shareholders and 98.6% of Standard Life shareholders voted for the merger.

Aberdeen shares rose 5% and Standard Life shares rose 2.5%.

The merger, announced in March, is due to complete in August.

Standard Life chairman Gerry Grimstone said: “Our merger with Aberdeen will be one of the most significant events in our near-200 year history, creating a well-diversified world-class investment company.

“Proudly headquartered in Scotland, and employing some of the best talent in our industry, our new combined company will continue to put our customers and clients across the world at the centre of everything we do.

“There are still some approvals to be granted before the merger can complete and I know the teams in both companies are working through these diligently.

“We are still on track for a completion date of Monday 14 August and will keep our shareholders informed of developments.”

Aberdeen Asset Management chairman Simon Troughton said: “We are pleased with the overwhelming support Aberdeen shareholders have shown for the proposed merger.

“They recognise the strategic and financial rationale of the transaction which will create the UK’s largest active asset manager and one of the top 25 globally.

“The two businesses’ investment capabilities and distribution channels are highly complementary and by combining them we are well positioned to compete in an evolving global market environment.

“The strengths of the combined businesses in multi-asset and solutions, alternatives and active specialities, such as emerging markets, are strongly aligned to the needs of clients now and in the future.

“The new company will have a robust balance sheet and diverse revenue streams, by asset class and distribution channel. This will facilitate investment in the business to support long-term growth and shareholder returns.

“Today represents another landmark for Aberdeen, which started 34 years ago as a £70 million investment trust and grew to become a world-renowned asset manager managing billions of assets and employing thousands of people around the globe.

“This deal opens up significant opportunities across all facets of Aberdeen’s business and is an important step towards realising the company’s ambition of creating a world-class investment business with a truly global footprint.”