Latest data from fund research giant Morningstar shows that smaller companies funds maintained their 2021 winning streak in April, with European funds “leading the charge.”

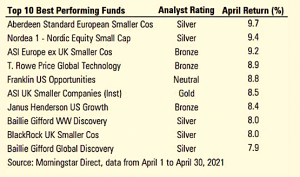

Funds managed by Edinburgh-based firms Aberdeen Standard Investments (ASI) and Baillie Gifford dominated the list of Top 10 performers (see below), with five places between them.

The funds were: Aberdeen Standard European Smaller Companies, ASI Europe ex UK Smaller Companies, ASI UK Smaller Companies (Inst), Baillie Gifford Worldwide Discovery and Baillie Gifford Global Discovery.

“While the Eurozone has just gone into a double-dip recession as the economic fallout from the coronavirus continues, a European smaller companies fund was the best performer under Morningstar coverage last month,” said Morningstar.

“Silver-rated Aberdeen Standard European Smaller Companies, just sneaked into the top spot with a gain of 9.7% in April.

“The €1.5 billion fund has a 52% weighting towards the Eurozone, a 14% allocation to countries outside of the currency bloc, and a 33% weighting towards the UK.

“Top holdings include UK-listed asset management firm Intermediate Capital and Finland retail conglomerate Kesko.”

Morningstar analyst Samuel Meakin said: “An experienced small-cap manager applying a proven process to a European opportunity set makes SLI European Smaller Companies a strong choice in the space.”

Nordea’s Nordic Equity Small Cap fund was a close second last month with a gain of 9.4%.

“Two UK smaller companies funds make it into the top 10, Gold-rated ASI UK Smaller Companies with a gain of 8.5%, and Silver-rated BlackRock UK Smaller Companies, which rose 8% in April and is up more than 14% in 2021 so far,” added Morningstar.

“But it is wasn’t all one way traffic for smaller companies funds – tech-focused T Rowe Price Global Tech, with top holdings including 2020 winners Zoom and Amazon.

“Two funds that gained around 75% last year, making them the third and fourth best performers in 2020, were Baillie Gifford Worldwide Discovery and Baillie Gifford Global Discovery.

“These two tech-heavy funds have Silver Ratings, and posted gains of 8% in April, but have endured different fortunes in 2021 as global investors favour value and recovery stocks over tech giants: the Worldwide Discovery fund is down nealy 10% in the year to date, but the Global Discovery fund is around 0.2% lower so far in 2021.”